Not for distribution to U.S. news wire services

or for dissemination in the United States

Vancouver, British Columbia, November 13, 2025 – Vizsla Copper Corp. (TSX.V: VCU, OTCQB: VCUFF) (“Vizsla Copper” or the “Company”) is pleased to announce that it has entered into a share purchase agreement (the “Share Purchase Agreement”) with American Pacific Mining Corp. (“American Pacific”) which holds the Palmer VMS project, located in southeast Alaska (the “Palmer Project”), pursuant to which the Company proposes to acquire all of the issued and outstanding securities of Constantine Metal Resources Ltd. (“Subco”), a wholly-owned subsidiary of American Pacific (the “Acquisition”).

Transaction Highlights

- High-grade copper, zinc, silver, gold and barite: The Palmer Project is an advanced-stage critical minerals exploration project in Southeast Alaska, with 60 kilometers of road access to tidewater.

- Strong resource with growth potential:

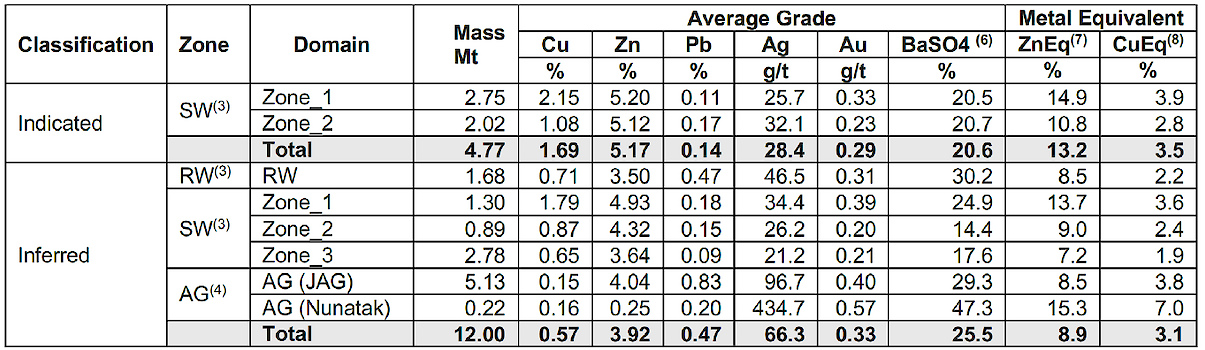

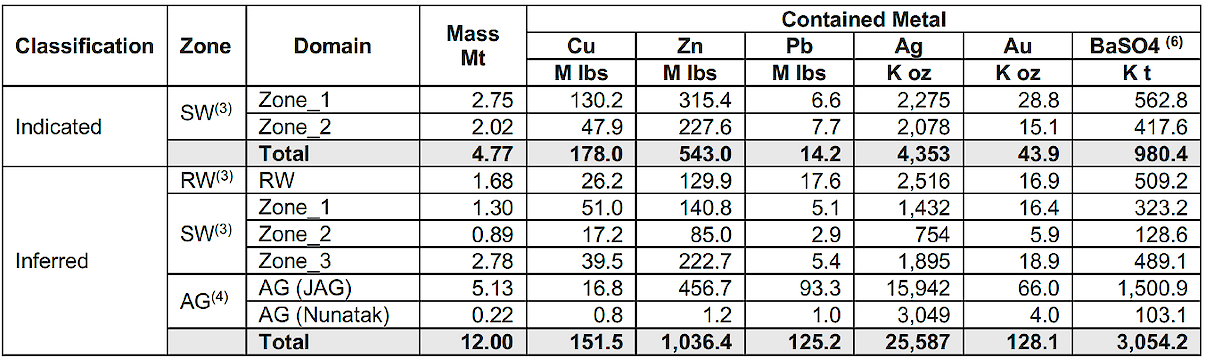

- Indicated: 4.77 million tonnes at 1.69% copper, 5.17% zinc (3.5% CuEq or 13.2% ZnEq)*. 178.0 million pounds of copper, 543.0 million pounds of zinc, with precious metals and barite (Table 1)

- Inferred: 12.00 million tonnes at 0.57% copper, 3.92% zinc (3.1% CuEq or 8.9% ZnEq)*. 151.5 million pounds of copper, 1,036.4 million pounds of zinc, with precious metals and barite (Table 1)

- 2023 High-grade copper intercepts from recent drill programs5:

- 43.8 meters of 6.54% copper, 3.15% zinc, 0.42 g/t gold and 27.97 g/t silver (8.22% copper equivalent, CuEq**, in hole CMR23-172)

- 37.1 meters of 4.57% copper, 8.44% zinc, 0.50 g/t gold and 29.33 g/t silver (8.40% CuEq**, in hole CMR23-167)

- 33.2 meters of 5.48% copper, 7.22% zinc, 0.64 g/t gold and 36.78 g/t silver (8.95% CuEq**, in hole CMR23-169)

- 23.9 meters of 9.03% copper, 3.49% zinc, 0.83 g/t gold and 41.75 g/t silver (11.15% CuEq**, in hole CMR23-171)

- Significant capital invested: Over US$116M has been invested on the Palmer Project to date establishing a strong foundation for the 2025 mineral resource estimates, with road access, and all state and federal permits in place for rapid advancement.

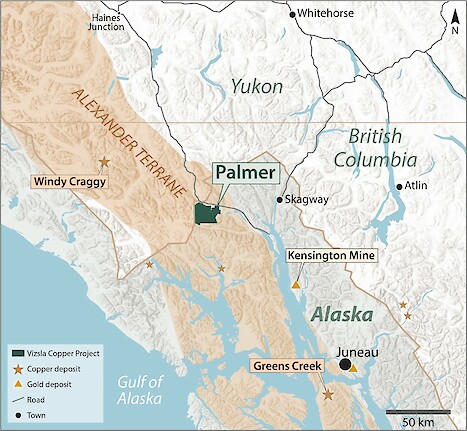

- A Proven VMS Belt extending over 1,000 kilometers throughout southeast Alaska and into Canada to the north and south. Proximal to established mining operations and infrastructure including Greens Creek (Hecla, Ag, Zn), and Kensington (Coeur, Au).

* Copper equivalent (CuEq) and Zinc equivalent (ZnEq) equations for the 2025 mineral resource estimate are listed in notes below Table 1

**Copper equivalent (CuEq) for the 2023 drill results = (Cu/100*2204.6*$lbCu*CuREC) + (Zn/100*2204.6*$lbZn*ZnREC) + (Au/31.1035*$ozAu*AuREC) + (Ag/31.1035*$ozAg*AgREC) / (2204.6/100*$lbCu*CuREC) using assumed metal prices of US$1.15/lb for Zn, US$3.00/lb for Cu, US$1250/oz for Au, US$16/oz for Ag and estimated metal recoveries (REC) of 93.1% for Zn, 89.6% for Cu, 90.9% for Ag and 69.6% for Au. See references for source of data, January 10th, 2024 American Pacific News Release

Craig Parry, Vizsla Copper’s Chairman and CEO, commented: “This is a transformational day for Vizsla Copper. I’ve spent the past 25 years searching for high-grade copper deposits and understand how rare it is to find a project like Palmer, and even rarer to find one in such a strategic location. High-grade projects like Palmer allow for tremendous flexibility when it comes to delivering environmentally sustainable small footprint operations. Importantly, we pride ourselves on working constructively in collaboration and consultation with traditional landowners and communities and look forward to engaging positively with people and groups in the region.

The world and the United States are desperate for critical mineral projects, further emphasizing the importance of Palmer. Simply put, this is the right asset at the right time. We thank the team at American Pacific for working to complete this agreement in a timely manner. We look forward to deploying a two-pronged approach in 2026, advancing the Palmer Project in Alaska while simultaneously advancing the Thira discovery in British Columbia, resulting in year-round exploration and news flow. The team and I look forward to building Vizsla Copper into the preeminent North American critical minerals explorer and developer.”

Warwick Smith, CEO of American Pacific Mining commented: “We have always viewed Palmer as one of Alaska’s most prospective critical metals projects. With our transaction-focused approach to creating value for shareholders, we believe that Palmer deserves a dedicated team and focused resources to fully realize its potential. Vizsla Copper has demonstrated the technical/corporate expertise and commitment necessary to effectively advance the Project, and we are confident they are the right group to move it forward. We’re excited to participate as shareholders of Vizsla Copper in the next stage of value creation as Palmer advances under their stewardship.”

Palmer Project

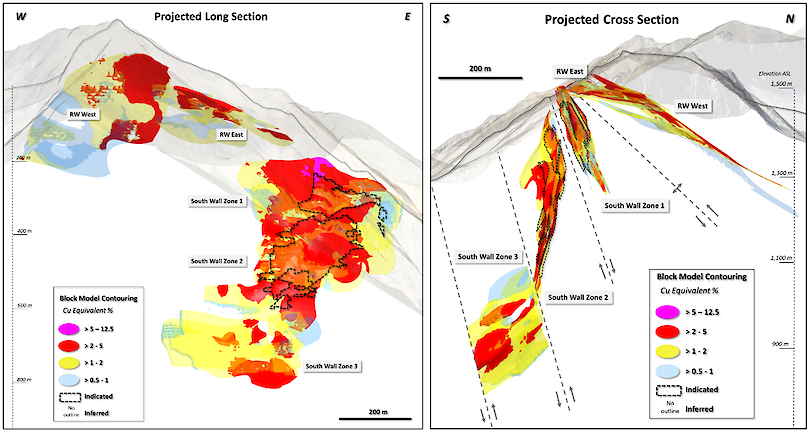

The Palmer Project is an advanced stage volcanogenic massive sulfide (VMS) project located in southeast Alaska, 60 kilometers from tidewater. The 33,000 hectare project hosts a mineral resource of 4.77Mt at 3.5% CuEq Indicated1 (1.69% copper, 5.17% zinc, 0.14% lead, 28.4 g/t silver, 0.29 g/t gold, 20.6% BaSO4) and 12Mt at 3.1% CuEq Inferred1 (0.57% copper, 3.92% zinc, 0.47% lead, 66.3 g/t silver, 0.33 g/t gold, 25.5% BaSO4) established across two main deposits, the Palmer Deposit and the AG Deposit (Tables 1 and 2). All claims comprising the Palmer Project are in good standing, with all the necessary permits in place to explore and complete the next phase of engineering and analysis.

Figure 1. Map showing the location of the Palmer Project in relation to local infrastructure and nearby mines.

Table 1: Palmer Project Mineral Resource Estimate Grades (effective date of January 13, 2025)

See Mineral Resource notes below Table 2

Table 2: Palmer Project Mineral Resource Estimate Contained Metal (effective date of January 13, 2025)

Mineral Resource Notes:

(1) Parsons, B and Kelloff, K, 2025: NI43-101 Technical Report Mineral Resource Estimate Palmer Project, Alaska, USA. Report prepared for Constantine Metal Resources by SRK Consulting (US), Inc. Effective date January 13, 2025.

(2) Mineral Resources, which are not Mineral Reserves, do not have demonstrated economic viability. The deposits have been classified as Indicated and Inferred based on confidence in the geological model, drill spacing. The estimate of Mineral Resources may be materially affected by environmental, permitting, legal, title, market or other relevant issues. The quantity and grade of reported Inferred Resources are uncertain in nature and there has not been sufficient work to define these Inferred Mineral Resources as Indicated or Measured Resources. There is no certainty that any part of a Mineral Resource will ever be converted into reserves.

(3) Mineral resources are reported using an assumed NSR which includes prices, recoveries, and payabilities cut-off grade based on metal price assumptions*, variable metallurgical recovery assumptions**, mining costs, processing costs, general and administrative (G&A) costs and variable NSR factors. Mining (US$41.3), processing (US$23.92) and G&A costs (US$11.77) and Sustaining Capital (US$15.92) totaling US$92.9/t for Underground Mining.

(*) Metal price assumptions considered for the calculation of Metal Equivalent grades are: Gold (US$/oz 2,100.00), Silver (US$/oz 28.0), Copper (US$/lb 4.50), Lead (US$/lb0.95) and Zinc (US$/lb 1.50).

(**) Cut-off grade calculations assume variable metallurgical recoveries as a function of grade and relative metal distribution. Average metallurgical recoveries are: SW/RW Zones: Gold (76.1%), Silver (90.2%), Copper (90.3%), Lead (82.9%) and Zinc (89.2%), AG Zone: Gold (66.0%), Silver (91.0%), Copper (54.8%), Lead (83.4%) and Zinc (94.8%).

(4) NSR Calculations for SW/RW Domains: NSR= $77.25 x %Cu + $20.32 x %Zn + $9.64 x %Pb + $0.64 x g/t Ag + $43.07 x g/t Au

(5) NSR Calculation for AG Domain: NSR=$49.04 x %Cu + $22.25 x %Zn + $10.14 x %Pb + $0.70 x g/t Ag + $37.77 x g/t Au

(6) The resources are considered to have potential for extraction using underground methodology and constrained by mineable shapes. Resources are presented undiluted and in situ and are considered to have reasonable prospects for economic extraction.

(7) Barite as reported is shown for economic potential but has not been used in the NSR value at this stage.

(8) ZnEq defined by equation SW & RW = NSR value per block / $20.32; AG = NSR value per block / $22.25 (Note Barite has been excluded from the ZnEq and NSR calculations).

(9) CuEq defined by equation SW & RW = NSR value per block / $77.25; AG = NSR value per block / $49.04 (Note Barite has been excluded from the CuEq and NSR calculations).

(10) Mineral Resources are based on validated data, which have been subjected to QA/QC analysis, using capped, composited samples at 2m. Estimation has been completed using a combination of Ordinary Kriging and Inverse Distance estimation methodologies and classified based on confidence in the underlying data and drill spacing. Mineral resource tonnages have been rounded to reflect the precision of the estimate.

(11) The mineral resources were estimated by Benjamin Parsons, BSc, MSc Geology, MAusIMM (CP) #222568 of SRK, a Qualified Person as defined by NI 43-101.

Figure 2: Projected long section (looking north) and projected cross section (looking west) of the Palmer Deposit showing the mineralized domains and block model outlines. See American Pacific’s January 20th, 2025 News Release, and updated 43-101 technical report1 with an effective date of January 13, 2025, sedar.ca.

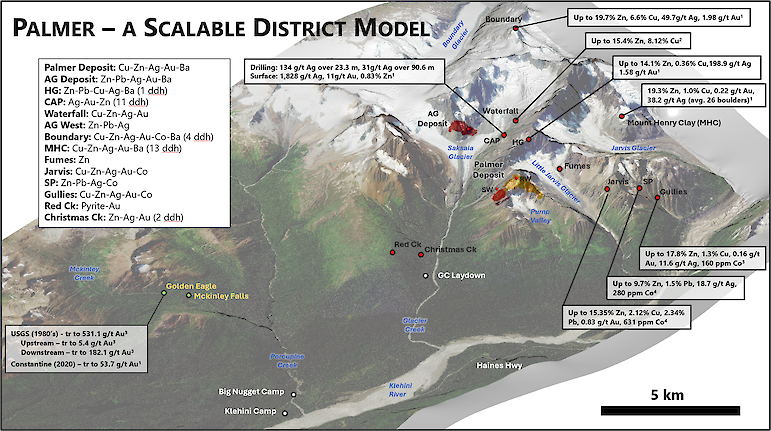

VMS-related copper-zinc-lead-silver-gold-barite mineralization across the Palmer Project, including the Palmer and Ag deposits, is hosted in a prospective belt of Late Triassic, rift-related volcanic and sedimentary rocks of the Alexander Terrane host to other significant VMS occurrences, prospects and deposits including the Windy Craggy copper-cobalt-silver-gold-zinc deposit in British Columbia, and the Greens Creek silver-zinc-lead-gold mine in southeast Alaska (Figure 1). Numerous drill-ready VMS prospects are dispersed along more than 15 km of prospective stratigraphy that remains largely under-explored (Figure 3).

Figure 3. Southwest looking view of the Palmer Project showing the distribution of under-explored high-grade exploration targets. See references below for sources of data.

Terms of the Share Purchase Agreement

Under the terms of the Share Purchase Agreement, Vizsla Copper will acquire all of the outstanding shares of Subco for $15,000,000, which shall be settled through the issuance of post-Consolidation common shares in the capital of the Company (“Common Shares”, and as issued hereunder the “Consideration Shares”). The Consideration Shares shall be issued at the same price as the NFT Shares (as defined below).

Vizsla Copper has also agreed to make the following milestone payments to American Pacific (collectively, the “Milestone Payments”):

- $5,000,000 payable upon the public disclosure by Vizsla Copper of an updated mineral resource estimate for the Palmer Project prepared in accordance with National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101”), which delineates a total of not less than 22 million tonnes of mineralized material; and

- $10,000,000 payable upon the commencement of commercial production at the Palmer Project.

Each Milestone Payment shall be satisfied, at the election of the Company, in cash or by the issuance of common shares of the Purchaser (the “Milestone Shares”), provided that the Company obtains any approval required under Exchange policies for any issuance of Milestone Shares and subject to applicable securities laws and stock exchange policies. The number of any Milestone Shares to be issued will be determined in accordance with the terms set forth in the Share Purchase Agreement and with the policies of the TSXV (the “Exchange”).

In connection with the Acquisition, American Pacific has agreed to a series of protective covenants in favour of the Company, including a 36-month standstill restricting it from acquiring additional securities of the Company or seeking to influence management or board composition; an obligation to vote any shares of the Company held in accordance with the recommendations of the Company’s board of directors; prohibitions on short sales, hedging or derivative transactions; and requirements to provide advance notice of any future share sales and to cooperate in ensuring an orderly market. American Pacific will not have any board nomination, information, anti-dilution, pre-emptive, top-up or participation rights.

The Share Purchase Agreement provides that the Acquisition is subject to several conditions including, among other things, completion of the Concurrent Financing for aggregate gross proceeds of at least $5,000,000, and receipt of all regulatory approvals and third-party consents, including Exchange approval.

The Acquisition is an arms’ length agreement. No finders fee will be payable to any party with respect to the Acquisition.

10:1 Share Consolidation

As part of Vizsla Copper’s long-term corporate strategy, the board of directors of the Company has recommended and authorized a consolidation of the Company's outstanding common shares on the basis of one post consolidation common share for ten pre consolidation common shares (the “Consolidation”). The Consolidation remains subject to Exchange approval. The effective date and further details of the Consolidation will be disclosed in a subsequent news release.

Concurrent Financing

The Company is pleased to announce a non-brokered concurrent financing of up to $25,000,000 that will, upon completion of the Consolidation, consist of the issuance of a combination of:

- up to 18,518,519 post-Consolidation common shares of the Company (“NFT Shares”) at price of $1.08 per NFT Share for gross proceeds of up to $20,000,000; and

- flow-through post-Consolidation common shares of the Company (“FT Shares”) at a price of $1.24 per FT Share and charity flow-through post-Consolidation common shares of the Company (“CFT Shares”, together with the NFT Shares and the FT Shares, the “Financing Shares”) at a price of $1.72 per CFT Share for gross proceeds of up to $5,000,000.

The FT Shares and CFT Shares will be offered by way of the “accredited investor” and “minimum amount investment” exemptions under National Instrument 45-106 – Prospectus Exemptions (“NI 45-105”) in all the provinces of Canada. The NFT Shares will be offered pursuant to Section Part 5A.2 of National Instrument 45-106 Prospectus Exemptions, as amended by Coordinated Blanket Order 45-935 – Exemptions from Certain Conditions of the Listed Issuer Financing Exemption to purchasers in Canada (other than the province of Quebec). The Agents will also be entitled to offer the NFT Shares for sale in the United States pursuant to available exemptions from the registration requirements of the United States Securities Act of 1933, as amended (the “U.S. Securities Act”), and in certain other jurisdictions outside of Canada and the United States provided it is understood that no prospectus filing or comparable obligation, ongoing reporting requirement or requisite regulatory or governmental approval arises in such other jurisdictions. In connection with the Offering, the Company may pay finders’ fees in accordance with the policies of the TSX Venture Exchange. Eventus Capital Corp. has been appointed as a finder in connection with the Offering.

The Company plans to use the proceeds of the Concurrent Financing as follows:

- an amount equal to the gross proceeds from the sale of the FT Shares and the CFT Shares will be used by the Company to incur “Canadian critical minerals exploration expenses” that qualify as “critical mineral flow-through mining expenditures” and/or Canadian exploration expenses” that qualify as “flow-through mining expenditures”, as such terms are defined under the Income Tax Act (Canada) related to the Company’s mineral properties in British Columbia; and

- the net proceeds from the sale of the NFT Shares will be used by the Company for: (i) exploration of the Palmer Project, (ii) continued exploration on Vizsla Copper’s mineral properties in British Columbia, with a principal focus on the Poplar copper-gold project, (iii) costs of completing the Acquisition, and (iv) general working capital.

The current intended exploration expenditure allocation among the Company’s projects from the Concurrent Financing will be:

- Approximately $17,000,000 on the Palmer Project including drilling, assays, and geophysics.

- Approximately $5,000,000 million on the Poplar project including drilling, assays, and geophysics.

The Acquisition and the Concurrent Financing are expected to close on or about December 4, 2025. The Transaction remains subject to certain conditions including, but not limited to, the receipt of all necessary regulatory and other approvals including the approval of the Exchange.

There is an offering document (the “Offering Document”) related to the offering of NFT Shares that can be accessed under the Company’s profile on SEDAR+ at www.sedarplus.ca and the Company's website at www.vizslacopper.com. Prospective investors of NFT Shares should read the Offering Document before making an investment decision.

Resale Restrictions

The Consideration Shares, FT Shares and CFT Shares will be subject to a four-month and one day hold period in Canada. The NFT Shares will not be subject to a hold period in Canada, subject to any hold periods required by the Exchange.

In addition, the Consideration Shares will also be subject to a contractual hold period following the closing of the Proposed Transaction. American Pacific has agreed not to, directly or indirectly, sell, assign, transfer, pledge, or otherwise dispose of any Consideration Shares until they become eligible for sale in four equal tranches as follows: 25% six months after the closing; an additional 25% nine months after the closing; an additional 25% twelve months after the closing; and the remaining 25% fifteen months after closing.

Caution to US Investors

This news release does not constitute an offer to sell or a solicitation of an offer to buy any of the securities in the United States. The securities have not been and will not be registered under the U.S. Securities Act or any state securities laws and may not be offered or sold within the United States or to U.S. Persons unless registered under the U.S. Securities Act and applicable state securities laws or an exemption from such registration is available.

Qualified Person

The technical content of this news release regarding the Palmer Project has been reviewed and approved by Peter Mercer, P.Geo., Vice President of Advanced Projects for American Pacific, a qualified person as defined by National Instrument 43-101.

The technical content of this news release regarding Vizsla Copper’s properties has been reviewed and approved by Christopher Leslie, Ph.D., P.Geo., Technical Advisor for Vizsla Copper, a qualified person as defined by National Instrument 43-101.

Notes

- Adjacent Properties: The Company has no interest in, or rights to, any of the adjacent properties mentioned, and exploration results on adjacent properties are not necessarily indicative of mineralization on the Company’s properties. Any references to exploration results on adjacent properties are provided for information only and do not imply any certainty of achieving similar results on the Company’s properties.

- Historical Data: This news release includes historical information that has been reviewed by Vizsla Copper’s and/or American Pacific’s qualified person. Vizsla Copper’s and/or American Pacific’s review of the historical records and information reasonably substantiate the validity of the information presented in this presentation. Vizsla Copper encourages readers to exercise appropriate caution when evaluating these data and/or results.

- Third-Party Mineral Projects: These deposits are cited solely for geological context. The Company cautions that these properties are not adjacent to, nor does the Company or American Pacific have any interest in or control over them. Although certain geological features may be similar, there is no assurance that mineralization comparable to these deposits will be discovered on any of the Company’s properties or the Palmer Project. The potential quantity and grade, if any, on any of the Company’s properties or the Palmer Project are conceptual in nature and there has been insufficient exploration to define a mineral resource. It is uncertain whether further exploration will result in the delineation of a mineral resource. Information regarding the aforementioned deposits is taken from publicly available sources and technical reports believed to be reliable, but has not been independently verified by the Company or American Pacific.

- Mineral Resource Estimate (MRE): All scientific and technical information relating to the Palmer Project pertaining to the Palmer Mineral Resource Estimate (“Palmer MRE”) contained in this news release is derived from the Technical Report dated February 28, 2025 (with an effective date of January 13, 2025) titled “NI 43-101 Technical Report, Mineral Resource Estimate, Palmer Project, Alaska, USA” (the “Palmer Technical Report”) prepared by Ben Parsons, MSc, MAusIMM (CP) and Kash Kelloff, BSc ChemE, MBA, SME, MMSAQP of SRK Consulting (U.S.), Inc. The information contained herein in respect of the Palmer MRE is subject to all of the assumptions, qualifications and procedures set out in the Palmer Technical Report and reference should be made to the full text of the Palmer Technical Report, a copy of which has been filed with the applicable securities regulators and is available under American Pacific’s profile on www.sedarplus.ca.

- References:: (1) Parsons, B and Kelloff, K, 2025: NI43-101 Technical Report Mineral Resource Estimate Palmer Project, Alaska, USA. Report prepared for Constantine Metal Resources Ltd. by SRK Consulting (US), Inc. Effective date January 13, 2025; (2) Constantine Metal Resources Ltd., Press Release, November 24, 2015; (3) Still, J.C. et al. 1991. Economic Geology of the Haines–Klukwan–Porcupine Area, Southeast Alaska. U.S. Bureau of Mines; (4) Constantine Metal Resources Ltd., Geochemical Database and (5) American Pacific Mining Corp., Press Release, January 10, 2024

ABOUT VIZSLA COPPER

Vizsla Copper is a Cu-Au-Mo focused mineral exploration and development company headquartered in Vancouver, Canada. The Company is primarily focused on its Poplar and Woodjam projects, well situated amongst significant infrastructure in Central and Southern British Columbia. The Company’s growth strategy is focused on the exploration and development of its copper properties within its portfolio in addition to value accretive acquisitions. Vizsla Copper's vision is to be a responsible copper explorer and developer in the stable mining jurisdiction of British Columbia, Canada and it is committed to socially responsible exploration and development, working safely, ethically and with integrity.

Vizsla Copper is a spin-out of Vizsla Silver and is backed by Inventa Capital Corp., a premier investment group founded in 2017 with the goal of discovering and funding opportunities in the resource sector. Additional information about the Company is available on SEDAR+ (www.sedarplus.ca) and the Company’s website (www.vizslacopper.com).

CONTACT INFORMATION

For more information and to sign-up to the mailing list, please contact:

Craig Parry, Chief Executive Officer and Chairman

Tel: (604) 364-2215 | Email:info@vizslacopper.com

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Forward-Looking Statements

This news release includes certain statements and information that constitute forward-looking information within the meaning of applicable Canadian securities laws. All statements in this news release, other than statements of historical facts, are forward-looking statements. Such forward-looking statements and forward-looking information specifically include, but are not limited to, statements that relate to the completion of the Acquisition or the Concurrent Financing, the planned use of net proceeds of the Concurrent Financing, the tax treatment of the FT and the CFT Shares, the renouncement of applicable expenditures and timely receipt of all necessary approvals, including any requisite approval of the Exchange, and exploration and development of the Company.

As well, forward-looking Information may relate to: future outlook and anticipated events, such as the consummation and timing of the Acquisition and Concurrent Financing; the strategic vision for the Company following the closing of the Acquisition and expectations regarding exploration potential, and future financial or operating performance of Vizsla Copper post-closing; the satisfaction of the conditions precedent to the Acquisition; the success of the Company and Subco in combining operations upon closing of the Transaction; the anticipated benefits and impacts of the Acquisition or the Concurrent Financing; use of proceeds from sale of the FT Shares and the CFT Shares, the renunciation of applicable expenditures; the proposed tax treatment of the FT Shares and the CFT Shares, the results from work performed to date; the estimation of mineral resources and reserves; the realization of mineral resource and reserve estimates; the development, operational and economic results of technical reports on mineral properties referenced herein; magnitude or quality of mineral deposits; the anticipated advancement of the Company’s mineral properties and project portfolios; exploration expenditures, costs and timing of the development of new deposits; underground exploration potential; costs and timing of future exploration; the completion and timing of future development studies; estimates of metallurgical recovery rates; exploration prospects of mineral properties; requirements for additional capital; the future price of metals; government regulation of mining operations; environmental risks; the timing and possible outcome of pending regulatory matters; the realization of the expected economics of mineral properties; future growth potential of mineral properties; and future plans, projections, objectives, estimates and forecasts and the timing related thereto.

Statements contained in this release that are not historical facts, including all statements regarding the planned completion of the Acquisition and the Concurrent Financing, are forward-looking statements that involve various risks and uncertainty affecting the business of the Company. Such statements can generally, but not always, be identified by words such as "adjacent", "plans", "prolific", "focus", “extension”, “intended”, “advance”, “potential”, “opportunity,” “impact”, “establish”, “propose”, “strategic”, “important”, “plan”, “milestone”, “prime”, “success”, “undertake”, “provide”, “preeminent”, “contemplate”, “exposure”, “strong”, “transformation”, “represent”, “numerous”, “accessible”, “intension”, “ability”, “intend”, “identify”, “expand”, variants of these words and similar expressions, or that events or conditions “will”, “would”, “may”, “could” or “should” occur. All statements that describe the Company's plans relating to operations and potential strategic opportunities are forward-looking statements under applicable securities laws. These statements address future events and conditions and are reliant on assumptions made by the Company's management, and so involve inherent risks and uncertainties, including, the inability to satisfy the conditions precedent to complete the Acquisition; the inability to complete the Concurrent Financing; the ability or inability to obtain all necessary regulatory approvals for the Acquisition and the Concurrent Financing, including Exchange approval; the realization of benefits from the Acquisition and the Concurrent Financing; permits, the inability to use the proceeds from sale of the FT Shares and the CFT Shares as intended, the inability to renounce applicable expenditures; the availability of the proposed tax treatment of the FT Shares and the CFT Shares; consents or authorizations required for mining activities, and material delays in obtaining them; the absence of adverse conditions at mineral properties; no unforeseen operational delays; the price of silver and other metals remaining at levels that render mineral properties economic; the Company’s ability to continue raising necessary capital to finance operations; and the ability to realize on any mineral resource and reserve estimates; the Company’s ability to complete its planned exploration programs; the absence of adverse conditions at properties; no unforeseen operational delays; the Company’s ability to continue raising necessary capital to finance operations; environmental regulations or hazards and compliance with complex regulations associated with mining activities; climate change and climate change regulations; fluctuations in exchange rates; the business objectives of the Company; whether economic mineralization can be defined and, if it can be permitted for development; the uncertainty that any mineralization encountered on adjacent properties continues on to any of the Company’s properties; the uncertainty that geological and/or geophysical and/or any trends, interpretations, or conclusions related to adjacent properties have relevance to any of the Company’s properties; the uncertainty that the exploration season can be extended; changes in project parameters as plans to continue to be refined; the consequences and implications of the historical mining activities on the environment and whether such affects the potential exploration and/or development of any mining operation the Company’s properties; the implications of claims from First Nations, Tribes, Tribal Councils, Tribal Governments, Alaska Native Corporations, Alaska Native Regional or Village Corporations and land claims settlements on the Company’s projects; accidents, labour disputes and other risks of the mining industry, conclusions of economic evaluations; meeting various expected cost estimates; benefits of certain technology usage; future prices of metals; possible variations of mineral grade or recovery rates; geological, mining and exploration technical problems; failure of plant, equipment or processes to operate as anticipated; accidents, labour disputes and other risks of the mining industry; the speculative nature of mineral exploration and development; title to properties, such further risks as disclosed in the Company's filings with Canadian securities regulators and management’s ability to anticipate and manage the foregoing risks and uncertainties. As a result of these risks and uncertainties, and the assumptions underlying the forward-looking information, actual results could materially differ from those currently projected, and there is no representation by the Company that the actual results realized in the future will be the same in whole or in part as those presented herein. Readers are referred to the additional information regarding the Company's business contained in the Company's filings with securities regulatory authorities in Canada on SEDAR+ (www.sedarplus.ca). Although the Company has attempted to identify important factors that could cause actual actions, events, or results to differ materially from those described in forward-looking statements, there may be other factors that could cause actions, events or results not to be as anticipated, estimated or intended. For more information on the Company and the risks and challenges of its business, investors should review the Company's filings that are available on SEDAR+ at www.sedarplus.ca.

The Company provides no assurance that forward-looking statements and information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements or information. Accordingly, readers should not place undue reliance on forward-looking statements or information. The Company does not undertake to update any forward-looking statements, other than as required by law.